Cost efficient

Streamlining credit processing and optimizing production costs.

Safe and scalable

Designed with an embedded fraud detection fire wall.

Fast & simple

Allowing financial institutions to propose a radically improved credit experience.

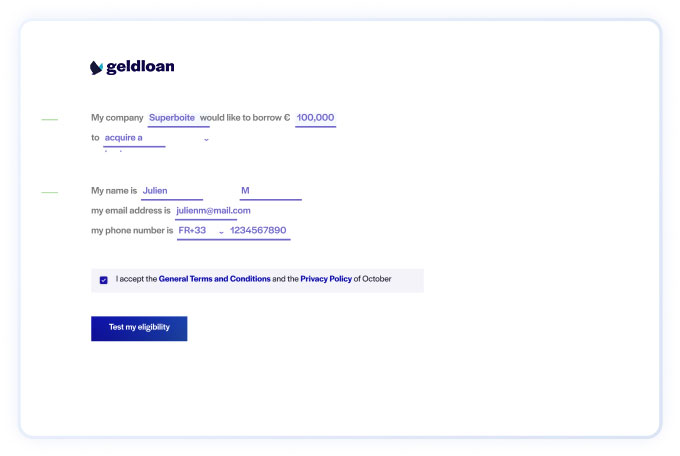

GeldLoan offers a fast, simple and predictable financing process.

Best in class user experience with a full online process and fast decision making.

Making borrowers' life simple by only asking for necessary documents and those we weren't able to retrieve ourselves.

Giving a clear vision of the process, the necessary steps and what is coming next.

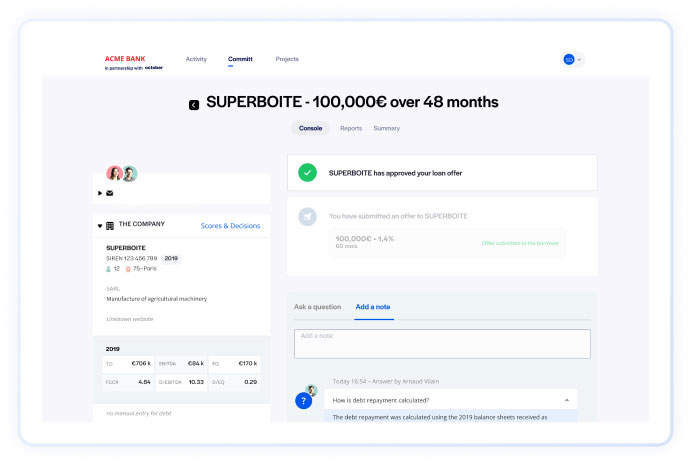

GeldLoan offers a simple, safe yet scalable end-to-end credit processing tool.

An integrated neo-lending solution offering value for each step of the process : credit analysis, credit validation, KYC, fraud detection, replacement of analysts manual works, …

Simplifying the workflow, improving document management and increasing decision making speed with tools such as SLA Manager.

Automating document reading and processing and improving fraud detection drastically.

Difficult market conditions

Banks are caught in a competitive and margin-vanishing environment. Their capacity to innovate is limited compared to new entrants who have no technological legacy.

Limited capacity to innovate

Their main challenge is to overcome an expensive model, weighted down by multiple layers of processes and manual activities and mostly resistant to change.

Higher customers expectations

Meanwhile their customers expectations in terms of user experience, speed, technology and client service have never been so high.

Our mission is to empower businesses to thrive by simplifying and democratizing their funding.

GeldLoan was born in USA at the end of 2014, thanks to a new regulation opening up the banking monopoly. Today we operate as a pan-American European lending platform dedicated to SMEs with offices in France, Spain, Italy, Switzerland, United Kingdom, Netherlands and Germany.

We have financed more than 450 millions worth of SME loans over the past 5 years.

The products we are able to support range from classic loan to specialized leasing solutions. We have gathered a community of more than 20 000 active private lenders and a group of top tier institutional investors (European Investment Bank, BpiFrance, CNP Assurances and more).

We are able to offer one of the simplest and fastest lending experience for SMEs.

Overall our processes can range from a credit decision in less than 5 minutes (for State Guaranteed loans under 250k) to 48 hours (for classic financing). Funds are typically transferred on the customers account within 3 days after credit decision.

We have invested a lot in technology and data from the start, creating this state of the art lending tech.

We now operate this technology not only for our financing platform but for financial institutions across United States so we can empower businesses to thrive by simplifying their funding, together.